2024 Q1 Newsletter

“When I get older, losing my hair,

Many years from now.

Will you still be sending me a Valentine?

Birthday greetings, bottle of wine?”

When I’m Sixty Four – Lennon, McCartney, 1967

Please click here to view/download the PDF version of this update.

Our CEO, Jon Ravenscroft, turned 60 at the end of March. It’s a milestone that caused a moment of contemplation – presumably significantly smaller than Jon’s – largely because it only seems like a heartbeat ago that we celebrated his 50th.

Time marches on at an ever-increasing pace (which might also be that age issue!), driving the world in which we live and the markets in which we choose to invest. For us to invest successfully on behalf of our clients, we need to understand the world we live in and, more importantly, the changes that may come our way in the future. A quote from Wayne Gretzky sums it up neatly. We need to “skate to where the puck is going, not where it has been”. Thus, it is crucial that the themes we were invested in when Jon turned 50 remain just as relevant as those we are investing in as he turns 60. These, in turn, should still be relevant when he turns 70!

It should come as no surprise that whilst we can be very confident in the outcomes of the themes themselves over the next decade, it is much harder to forecast the short term, i.e. what might get in the way of the puck. Another pandemic, inflation boom/bust and the ebb and flow of global geopolitical angst – seemingly increasing by the day and, currently, focused on the Middle East, but for how long? These risks can, to a reasonable degree, be offset by sensible portfolio diversification, balancing between different asset classes and, ultimately, the performance of the themes themselves over the longer term. Good quality fixed-income (bonds), for example, has been offering great value of late and, following a period of rising interest rates, is once again providing some downside protection to the equity portion of a portfolio.

Our long-term investment themes are overarching trends and opportunities that we expect to shape the investment landscape over an extended period, typically spanning several years or even decades and themselves driven by structural changes in the global economy, technological advancements and demographic shifts. They remain at the core of our portfolios and have performed well over the quarter: in GBP terms, for example, Healthcare has risen by 8.5% (1), Technology by 13.3% (2) and Discretionary by about 7% (3).

One strand that has continued to lag is our exposure to Emerging Markets and Southeast Asia. Whilst this is disappointing, a full review of our exposure still identifies good value in stocks and we firmly believe that these areas will see strong returns over the longer term.

From a market perspective, what has also been encouraging is that performance has broadened outside of the “Magnificent 7”. In fact, two of the M7 fell in value over the quarter: Apple by about 10% (4) and Tesla by 29% (5). As we mentioned at year end, 2023 was a year where you were rewarded for having a very focused portfolio. Thus far this year! investors are once again being rewarded for diversification. Long may it continue.

Cautious Portfolios

Lower Risk

by Tom Craske

Objective: The Cautious portfolio’s objective is to increase its value by predominantly allocating capital to fixed income investments. The portfolio can also invest into global blue-chip equities with strong cashflows and progressive dividend policies. A neutral position would be a 75% bond/25% equity split and the maximum equity-weighting of approximately 35%. The cash generated can be re-invested to provide capital or taken as an income stream.

If Q4 2023 was the party, then Q1 2024 certainly felt like the hangover – albeit a mild one. Late into last year, markets rallied on the pivot from interest-rate hikes to expected cuts. Such was this enthusiasm that, come January, a full seven cuts were projected by the end of 2024. We noted at the time that these expectations seemed unreasonable and had likely gone too far. In that sense, a retracement was somewhat inevitable, but nothing to be concerned about. Our prophesy proved correct – a broken clock is right twice a day, after all – and, in Q1, rate expectations and, subsequently, bond markets came back to earth. The equity market, meanwhile, has remained buoyant. Interest-rate expectations for 2024 now seem more realistic, which for the Income strategy is somewhat of a sweet spot. The portfolio offers an attractive yield and provides a solid backstop for any interest-rate volatility should it arise.

The Income strategy returned 1.2% (6) in the first quarter, a touch behind the IA Mixed Investment 0-35% Index, which returned 1.5% (7).

Contributors and Detractors

Despite the pullback in bond yields, the majority of our fixed-income managers posted positive returns over the quarter. It was our equity managers, however, that contributed most to performance. Seemingly unperturbed by the waning rate-cut expectations, the stock market rally broadened. Fidelity Global Dividend returned 7.6% (8) over the period and was the Income strategy’s top performer. Guinness Global Equity Income was another, returning 6.6% (9) for Q1. Ninety One Global Quality Dividend Growth, a fund recently reintroduced to the portfolio, returned 5.0% (10).

Allianz Strategic Bond, unsurprisingly, was the strategy’s greatest detractor for the period. The fund acts as recession protection: performance is intimately linked to movements in the US treasury market (and treasury market yields linked to rate expectations). As rate-cut expectations pared back over Q1, bond yields rose and gave back some of the gains made at the end of 2023; this move hurt Allianz’s performance with the fund returning -4.1% (11) over Q1. Likewise, Ruffer’s Total Return fund, where performance is also linked to movements in treasuries—though to a lesser extent—returned -0.9% (12) over the quarter.

KBI was another detractor in Q1, declining -3.4% (13). We have spoken previously and at length about the issues immediate to the sustainable infrastructure industry. These problems persist and the sector remains somewhat unloved. We do, however, believe the long-term investment case stands and that the fund offers significant value at current levels.

Prusik Asian Equity Growth also held back performance. The fund has around 40% combined exposure to Hong Kong and Chinese equities, which have fallen out of favour of late. Whilst the fund was negative over Q1, it is worth noting that we are starting to see a pickup in appetite for this once-unloved sector; and has rallied recently on increased optimism of government intervention.

Q1 Portfolio Changes

Going into the New Year, we were comfortable with the structure of the Income portfolio. The first quarter, accordingly, was a relatively quiet period for the strategy. We made one change to our equity allocation, reestablishing a position in Ninety One Global Quality Dividend Growth and trading out of Lazard Global Thematic Inflation Opportunities. Lazard was introduced in early 2023 to provide, as the name suggests, a measure of inflation protection into the portfolio. Sadly, the investment did not behave as we had anticipated. We invested into the fund when inflation began to turn down, which proved to be a difficult period for its style. While the fund had performed admirably in an inflationary environment, it underperformed relative to peers as inflation fell, rather than offer the two-way inflation resilience we expected. We decided to return to the Ninety One fund, which, with the benefit of hindsight has performed better over the volatile inflation period. Admitting you were wrong is difficult. Denying the fact and doing nothing is immeasurably worse.

Fortunately, Lazard was not the only change we have made to incorporate inflation resilience into the Income portfolio and our other changes have had better success. Funds like KBI Global Sustainable Infrastructure have added value in both rising and falling interest rate environments; a proposition we prefer over having a binary bet depending on the path of inflation.

2024

We remain of the opinion that improving market conditions portend a continued recovery in 2024. In the second quarter we will look to add further value to the Cautious strategy through our recent emerging market review, which Sam Dovey covers in more detail in the Growth commentary, below.

Higher Income:

Medium Risk

by Robert (Bob) Tannahill

Objective: The Higher Income portfolio’s objective is to provide investors with a current income that is higher than cash rates. The current income target is 6%. The portfolio invests across a diverse range of assets including dividend paying equities, investment grade and high yield bond and infrastructure investments. The cash generated is taken as an income stream.

The Higher Income strategy returned +1.6% on the quarter (14).

After the major rally bond investors experienced in November and December – the Federal Reserve finally blinked and indicated that interest rates had likely peaked – it was not entirely surprising to see some retracement in January. Indeed, investor sentiment has swung wildly over recent months: from assuming interest rates would stay high forever (and never again would we see rates below 4% in October) to assuming, by Christmas, an aggressive rate-cutting campaign from central banks starting as soon as March. We then saw another counter swing, this year, courtesy of some hotter than expected US inflation data in January and February. Centrals banks largely downplayed these numbers, however, and reaffirmed the market view that we are looking at two or three rates cuts in 2024 in the second half of the year. While markets often swing back and forth as they zero in on a sensible guess about the future, such swings are usually more subdued than we have seen in the last few months.

In the Higher Income strategy, most of our assets avoided the majority of the volatility since we have lower levels of exposure to the future path of interest rates than the broader bond market – and we also have a high level of interest income to buffer us along the way. This led to many of our funds putting in solid performances with strong returns from holdings such as the Titan Hybrid Capital Fund (+4.0% (15)) and GAM Star Cat Bond (+3.6% (16)). New entrant RLAM Sterling Extra Yield also did well returning (+3.5% (17)) since we initiated it on the 16th of January. Pacific EM Equity Income Opportunities also put in a notable performance rising an impressive +8.9% (18) thanks to a growing trend of the fund finding interesting niches within the emerging-market space, from which they have delivered superior returns to their peers.

One area that has suffered from persistently negative sentiment is the investment trust space. While two of our three trusts finished roughly flat on the quarter, The Renewables Infrastructure Group (“TRIG”) continued to suffer from negative sentiment, falling another -9.8% (19). We spoke with the team over the quarter, following the latest results, and remain confident in the quality and valuation of the fund – and therefore in the longer-term outlook. As the Higher Income strategy has grown, however, we have allowed the more volatile investment trust positions to shrink naturally relative to the other holdings. This better reflects the higher levels of short-term volatility that they are displaying at the moment.

Looking forward, although the path of macro-variables, such as interest rates, remains perpetually uncertain, we are very comfortable with the Higher Income strategy’s portfolio today. We have a diverse set of high quality assets and are being paid a good level of income in return for the natural ebb and flow of markets. For this reason, change has been limited to just one investment since launch – and that will remain the case unless we see parts of the portfolio start to look overly expensive.

Balanced Portfolios:

Medium Risk

by David Le Cornu

Objective: The Balanced portfolio’s objective is to provide capital appreciation through a balance of fixed income and global equities. A neutral position is a 50% bond/50% equity split and the maximum equity weighting is 60%. The cash generated can be re-invested to provide capital or taken as an income stream.

For a number of months, our view of the prospects of the global economy has been turning more constructive. We are increasingly confident that the story of the 2nd half of the year will be falling interest-rates, which will be positive for both bonds and equities. This is prompting an increased focus upon returns and a further reduction in the defensive positions we introduced into the Balanced strategy to safeguard against recession and rising inflation. At the same time, the deep-dive review of core themes to ensure their appropriateness for the next decade (and the right funds to access those themes) is ongoing. This will prompt some further portfolio changes but should help us to maximise returns for our investors over coming years.

It is pleasing to report that the Balanced strategy has returned 2.9% (20) during the first quarter, which is comfortably ahead of cash rates and inflation as well as in line with the peer group return of 2.5% (21) IA 20-60 index. The leaders and laggards in 2024 rhyme with last year, Sanlam AI, Bluebox Technology and Polar Insurance are leading the pack whilst Ruffer, Allianz Strategic Bond fund and KBI Global Sustainable Infrastructure are the laggards.

The focus of activity within the Balanced strategy over the quarter has been to increase the yield and to add to the technology and innovation theme in a very specific manner. The transactions undertaken were: (i) reduce Ruffer Total Return fund; (ii) sell 0-5 Year Gilt ETF; and, (iii) sell Lazard Global Inflation Opportunities. The majority of funds were reinvested with additions to: (iv) Muzinich EM Short Duration Bond fund; (v) introducing Fermat Cat Bond fund; and, (vi) Bluebox Technology fund – with the balance temporarily being held in cash. The rationale for the introduction of the new holdings is provided below.

The BlueBox Technology fund was introduced in January. During most of 2023, we had been searching for a technology fund that we believed could keep up with technology indices without leaning too heavily upon the Magnificent 7. Our reasoning for this approach is whilst the 7 are undeniably great businesses, we have concerns about the concentration and valuation risks that they represent. The BlueBox fund holdings are very different from most technology funds. Whilst their February 2024 fact sheet reflects Microsoft as their largest holding, at 6.0%, only two of the Magnificent 7 presently feature in their top 10. Accordingly, their exposure to the Magnificent 7 is less than half that of the average passive technology fund and is below their weightings in Global equity indices. The fund only has 17% invested in the mega-capitalisation stocks (market-cap above $400Bn) that dominate many passive and active technology funds.

The lead manager of BlueBox Technology Fund is William de Gale and his focus is upon companies enabling direct connection, thereby creating exposure to many exciting developments in the technology sector that both possess great growth potential and haven’t seen their valuations rise (yet) on the back of the excitement around AI. BlueBox has an exceptional track record: the February fact sheet notes an annualised return of +20.9% (22) since launch in 2018.

The Fermat Cat Bond fund was introduced in February and offers a high embedded yield and an uncorrelated return stream. From a portfolio construction perspective, it is a very attractive addition to the Bond content of a diversified portfolio. Whilst this is a bond investment, the primary determinant of investors’ returns will not be movements in interest rates and inflation. Instead, the bonds pay a fixed return above cash rates and will repay capital in full unless there is a claim in relation to the risks that the bonds have underwritten. The investment managers have managed the GAM Cat Bond fund for many years but have recently set up their own fund (Fermat). This allows us to invest in a proven investment strategy with an investment manager we know well and like (our Income strategy has had a holding in GAM Cat Bond fund for some time) but on improved commercial terms. The portfolio of underlying Cat Bonds has an average duration of 1.6 years and is paying a coupon of USD cash plus +8% per annum.

In April we will implement some changes to our Emerging Market exposures, the net result of which will mean that going forwards this part of the Balanced strategy will be less reliant upon the performance of Chinese equity markets. The rationale and transaction details will be included in our April fact sheet.

If you have any questions in relation to the Ravenscroft Balanced strategy, please don’t hesitate to get in touch.

Growth Portfolios:

Higher Risk

by Samantha Dovey

Objective: The Growth portfolio’s objective is to provide long-term capital appreciation by investing predominantly into global equities. A neutral position is a 25% bond/75% equity split and the maximum equity weighting is approximately 85%. The start to 2024 has been better than that of 2023.

Over the quarter the strategy posted 4.8% (23) versus the IA Sector 40%-85% of 4.2% (24).

The last three years have been challenging, covering everything from Covid and conflict to inflation. Over that timeframe, in our attempt to navigate such difficult times, we have made a number of changes to the strategy. As markets have improved, our attention has firmly fallen back to our core themes. As Mark mentions in the introduction, we are looking to ensure that our chosen themes (and exposure to them) remain relevant for the years ahead. Over Q1, we have made a number of changes and our thematic review has focused on our Emerging Market exposure.

Emerging Market and Asia Review

The closure of Arisaig gave us the opportunity to review the Emerging Market and, by extension, our Asian exposures. When we invest on your behalf, we are very cognisant of the underlying exposures the funds provide. For example, Arisaig focused on both consumption and e-commerce names. With this fund gone, it left the portfolio underweight the more traditional “growth” sectors of the region. Consequently, we carried out a review of the funds available to replace this investment.

We have focused on two funds, both of which were introduced to the portfolios in early April: Aubrey Global Emerging Markets and Polar Asian Stars.

Aubrey Global Emerging Markets – Invests in ‘Wealth progression’, this outlines the stages people go through as incomes rise and their needs and aspirations become more sophisticated. Quite simply, as consumers become richer, their shopping lists change. This pattern is predictable. At its simplest level, the portfolio managers are focused on finding companies that provide goods or services which make their customers lives more comfortable, congenial, or convenient.

Polar Asian Stars – The fund fills the growth segment within Asia through its innovation ‘tilt’. The team have been together for well over a decade and the process and fundamental work that goes on behind the scenes is exceptional. They invest thematically, which sits very well with our way of thinking. Currently, these cover: India (in both the domestic growth and new capex cycle); tech/semiconductor recovery; friend-shoring; electric vehicles; commodities; and, Vietnam.

Both funds provide exposure to our key theme of “the rise of the emerging consumer,” investing in the sectors we prefer, such as consumption and innovation.

Unfortunately, this meant the sale of First State Asian Growth. We have held this fund for over a decade and has been one of the cornerstones of our themes investing into emerging markets. The fund has always been a more “risk-off” allocation – insofar as it would not track a strong market rally but should defend in more difficult times – and Richard and his team have demonstrated this down the years.

Outlook

Whilst we are cognisant of the macro world in which we live, we also know that our long-term irrefutable themes will stand the test of time. Just as we did with the Emerging Markets and Asia review, we will be undertaking a global equity review in the coming quarter. There are many opportunities out there, but, as always, making sure we have the correct underlying exposures to match our clients’ needs remains our paramount concern.

Global Blue Chip Portfolios:

Higher Risk

by Ben Byrom

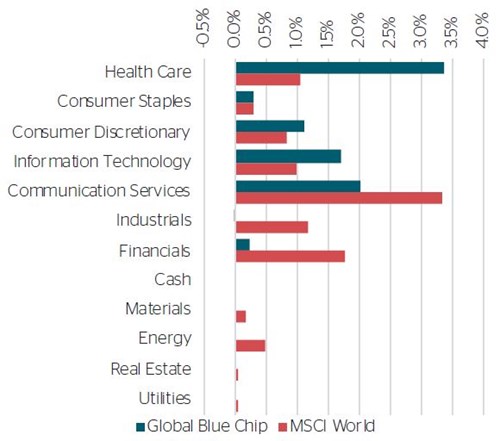

Objective: The Global Blue Chip portfolio invests into approximately 25-30 global blue chips that are in line with our long-term investment themes. The aim is to invest into such companies at an attractive valuation and hold them for the long term. The cash generated can be reinvested to provide capital growth or taken as an income stream.

The Q4 stock market rally carried its momentum through the first quarter of the year with the MSCI World Total Return (Net) registering a 9.9% (24) return in GBP, no doubt propelled by doveish comments throughout the quarter from Federal Reserve Chair, Jerome Powell, that rate cuts are (still) coming.

Recent market rotation in March from technology to commodity-related mining stocks, the sudden surge in gold and oil commodity prices, and the continued disintegration of the Magnificent 7, would suggest that the doveish chat is already starting to wear thin. Some investors are still sober enough to recognise that a share with a stretched valuation, without supportive fundamentals, poses significant downside risks when monetary liquidity starts to dry up and accompanying narratives start to sound hollow.

We are not in the game of predicting liquidity flows or market rotations. Our preference is to find thematically-aligned, quality businesses that are trading below their intrinsic value. That said, a 7.5% (25) return in one quarter is still a respectable start to any year!

The powerhouse behind the markets’ Q1 rally has been communication services, which is home to Mag 7 listings, Meta and Alphabet, as well as our own Walt Disney and Netflix (amongst other media and entertainment and telecommunication businesses). We sold our Alphabet position during the quarter predominately on concerns over an increasingly obstructive company culture that is now manifesting itself in the release of dysfunctional products – we see this as an unacceptable risk to future returns. Walt Disney was our strongest-performing stock, aided by a favourable earnings report that provided some clarity of management’s long-term targets for its direct-to-consumer streaming business. They also announced a joint-venture with FOX and Warner Bros. Discovery to build an aggregated sports streaming platform, shedding some light on the future for that business in response to the continued decline of linear TV viewership.

Healthcare was the biggest contributor to the portfolio’s overall return, aided by very good performances from GSK and Edwards Lifesciences. Alnylam was the portfolio’s biggest detractor after it announced marginal tweaks to the HELIOS-B statistical analysis plan. The market reacted rather negatively to this adjustment, suggesting sinister intentions for doing so. Management says otherwise and we believe them. Results are due June or early July.

Within technology it was a mixed bag of performances, from our perspective, with Adobe and Dropbox making the detractors’ list and Oracle making it onto the contributors’ list, following a well-received earnings report. Dropbox dropped a bomb on investors when it admitted that its core business in file save-and-share has effectively reached maturity and will see little growth in the near future. This contravened our original investment thesis, so we sold.

Our consumer holdings did well relative to market, especially within Discretionary, with strong contributions from the likes of Airbnb, eBay, Stellantis, and BMW. However, two holdings did make the detractors’ list: Nike and Etsy. During their recent Q4 earnings announcements, Etsy showed a decline in GMS whilst Nike guided a soft first-half, with growth geared more towards the second-half of the year; both announcements saw sharp sell-offs.

In a pro-growth, cyclical market, it was no surprise to see industrials and financials do rather well – areas where we are underweight. Our single exposure within financials is Visa, which is currently taking a breather after a strong run. We are unlikely to expand our interest in this sector, beyond payment companies, given the lack of balance-sheet transparency and regulatory involvement that favours financial stability across the banking sector. Within industrials, our underweight is for lack of attractively-priced opportunities. However, we did manage a relative value-switch between incumbent, Honeywell, and our new position, Rockwell Automation. Rockwell has been on our monitoring list for a while as a well-positioned play on the move towards automation and operating efficiency.

Global Solutions:

Higher Risk

by Shannon Lancaster

Objective: To generate capital growth over the long term (over 5-10 years). The strategy invests into 10-20 carefully selected third party equity funds; following the same, stringent investment process as the other multi-manager portfolios in our range. It is a highly focused portfolio which invests in companies providing goods and services dedicated to finding solutions to the challenges the world faces today.

Global Solutions returned 2.4% (26) over Q1 2024. It was a positive start to the year for markets as performance started to broaden beyond just the technology sector, which, despite posting a negative return in March, remains the top performer year-to-date. We were happy to see emerging markets recover some ground after a challenging year. The rebound in China helped our emerging equality exposure over the quarter. Energy transition remained a challenging area, although March brought some relief for these funds. Schroder Energy Transition recovered 6% (27) in March as many key exposures had sharp share-price increases. Elsewhere in the portfolio, our basic needs allocation performed well. Healthcare, particularly small and mid-cap, continued its rally from Q4 2023. Our top-performing fund in Q1 was Polar Healthcare Discovery, which returned 12.1% (28). We have been very pleased with how Regnan Water and Waste has behaved. Since launch it has been a key contributor to performance and over the past quarter it returned 9.8% (29). Some of our best-performing funds this year have been those that have large investible universes, which means they have more opportunity to diversify and adapt to a rapidly changing market environment and sentiment. Within niche spaces like water, we have found that blending exposure with food or waste, for example, can yield higher returns. Within each underlying theme, we also need to ensure we are sufficiently diversified. As an example, many people automatically think environmental solutions is purely about renewable energy producers, which, though they do play a crucial part, are just one of many investment opportunities; environmental solutions are thus both broad and diverse. Our underlying exposure ranges from energy efficiency technologies; water technologies and waste management; to software companies that are enabling the digitalisation of manufacturing. This diversified approach has benefitted many of our underlying funds since the launch of Global Solutions.

Our fund managers are always revisiting their universes, portfolios and processes to make sure they are capturing the most appropriate companies. We have been carrying out a similar process within our funds through our deep-dive reviews of core themes. While this work is still ongoing, we don’t anticipate a huge amount of change in the Global Solutions portfolio. We have made two changes to the Global Solutions since the fund launched, both of which have expanded our core exposures. In Q3 2023 we added Nordea Climate Engagement. In Q1 this year we added Wellington Global Stewards. The latter is focused on capitalising on the link between stewardship and return-on-capital. Their work has shown that excellent stewardship, as they define and measure it, is directly linked to a company’s ability to maintain attractive return-on-capital and increase long-term performance; this is covered in our Fund-in- Focus in more detail, below.

Another part of our review process is our decision-monitoring and analysis at various intervals. The goal is to find patterns and draw lessons from them, over time. We consider that having a good understanding of how we make decisions can only help us improve our choices in the long term. One way to dissect the decision-making process was brought to the fore in Nobel Prize-winner, Daniel Kahneman’s, seminal book, ‘Thinking, Fast and Slow’.

Kahneman, who passed away in March, posits that decision-making is not entirely based on conscious, rational thought. He outlines two distinct modes of thinking: “System 1,” often quick, ‘gut-feel’, instinctual choices based on prior learning and “System 2,” which is the slower, more deliberate and logical side. The hurdle is that even when we think we’re making decisions based on rational considerations, our System 1 biases, beliefs and intuition drive many of our choices.

So, as investors, what can we learn and apply from Thinking, Fast and Slow?

Applying Kahneman’s insight involves framing investment decisions in a way that aligns with the long-term objective of the fund. System 2 thinking plays a key role here, allowing us to step back and assess the bigger picture rather than reacting impulsively to short-term market movements. The goal is to avoid making reactive “System 1” driven decisions and focus on owning the best funds for the long term. We try to distinguish between skill and luck in reviewing the result of a decision by assessing the rationale written at the time, given the information we had then. This helps us highlight biases like overconfidence, loss aversion and anchoring. We are always looking for ways both to improve and to adjust our processes and thereby enhance the team’s decision-making skills. We hope, over time, that collecting, monitoring and interpreting the relevant data will provide us with the means to gain a better understanding of how and why we make decisions and, ultimately, help drive strong performance to enhance the overall client experience.

As we look forward to the rest of the year, we are pleased to see some positive performance momentum in our underlying Global Solutions funds. The themes underpinning the portfolio are still very much at play and unfolding around us. As global recognition grows, the companies we invest in will also benefit – powered by the long-term, irrefutable trends driving change.

Fund in Focus:

Wellington Global Stewards

by Shannon Lancaster

We have expanded the core environmental solutions exposure within Global Solutions with the addition of Wellington Global Stewards. This is a multi-sector, diversified, global equity fund run by a team that believes there is a strong link between stewardship and return-on-capital. Their work has shown that excellent stewardship, as they define and measure it, is directly linked to a company’s ability to maintain attractive return-on-capital and increase long-term performance

Why stewardship?

Stewardship is about building the future value of a company through strong leadership and the responsible and strategic management of natural, human and financial resources. For Wellington, good corporate stewardship means balancing the needs of all stakeholders in the pursuit of long-term returns. This entails investing in people, protecting the planet and increasing the resilience of future profits through innovation.

They believe that the combination of sustainable financial strength and superior stewardship is an important and often overlooked source of competitive advantage. As part of their process, they include an intense focus on these two factors. Companies that are good stewards balance all stakeholder interests in pursuit of sustainable returns and incorporate material ESG risks and opportunities into their corporate strategy.

The investment team believes that strong stewardship can help companies lower the cost of capital, become more durable and resilient, and sustain returns on capital over time. Stewardship contributes to stronger risk cultures, better capital management, and greater strategic clarity. Furthermore, stewardship can foster trust among customers, employees, shareholders, suppliers and other key constituents – and deepen employee loyalty.

Why is it included in the investment process?

They view return-on-capital and stewardship as interconnected crucial factors when assessing companies. They conduct rigorous research to identify and invest in companies that exhibit both characteristics, favouring large global industry leaders with robust competitive positions.

They believe a company with a strong management team and an empowered board is better placed to deliver sustained value and mitigate risk. By being a good steward of its capital and respecting the interests of all its stakeholders, a company can create a flywheel effect: strengthening its competitive position and profit margins, along with its resilience and ability to attract and retain customers, incentivise staff and strengthen its supply chain.

Engagement

A key part of the Stewards process is related to working with boards and management of companies. They want to establish whether boards are not only providing checks and balances, but that they are playing devil’s advocate to encourage challenge and a forward-thinking environment. They believe that board-level engagement is under-emphasised by the market and provides them a differentiated edge in evaluating a company’s long-term prospects.

A great example of this work was discussed at a recent meeting with fund manager Yolanda Courtines. Diageo, the global spirits business, had a change to leadership in 2023 as they welcomed new CEO Debra Crew. The Stewards team engaged with the CEO, CGO and Chair of the Board to discuss the business’ priorities and strategy. Debra explained her approach would be more “evolution than revolution” and made commitments to preserving a conservative balance sheet, upholding capital allocation discipline, and retaining focus on stakeholders. The various meetings they had gave the team confidence that the succession planning had been handled well and they concluded that further upside could come from greater operational efficiency, strengthening brand loyalty, and employee engagement across the business. This work then fed into their overall investment case for the stock and influenced their positioning.

Have they delivered?

The fund launched in January 2019 and has navigated a wide range of market regimes, both growth- and value-led markets, and risk-on and risk-off environments. Performance has been strong – with returns over 100% since inception – outperforming the MSCI ACWI by around 24%. The outperformance is the result of diversification, risk management and their emphasis on stock selection.

We believe the Stewards fund will be a useful tool for us and are confident they can continue to identify high-quality companies with a history of high returns-on-capital, with the stewardship to sustain those returns into the future.

Boscher's Big Picture:

On course for a soft landing

by Kevin Boscher

It looks increasingly likely that the US economy is on course for a soft landing and that the UK and Europe can avoid a meaningful recession this year.

A number of factors have combined to offset much of the impact from higher rates, including strong consumer and corporate balance sheets, a free spending US government, a further unwinding of the pandemic related supply chain and labour market disruption and lower commodity prices. At the same time, inflation is falling fast in many developed and developing economies, even if it is taking a bit longer than hoped to return to the targeted 2% level. Equities, in particular, have carried on the recovery that started last October and enjoyed a strong start to the year thanks to an improving growth and earnings outlook, disinflation and the prospect of easier monetary policy. Government bonds, on the other hand, have struggled as investors have pared back their expectations for rate cuts, especially longer duration issues. We are cognisant of near-term threats to this rosy macro backdrop, but optimistic that both equities and bonds will continue to deliver attractive returns over the rest of 2024 and beyond.

The US looks set to continue to outperform other advanced economies for some time to come. US consumers have reduced debt levels since the GFC and are enjoying strong income growth thanks to full employment, real wage growth and higher property and equity prices. Although the huge build up in their savings has largely been run down, rising wealth will continue to support spending and favour the US relative to the UK or Europe. The US is also in the midst of a cyclical upturn in productivity which feeds through to comparatively stronger growth in real average incomes, and thus supports consumption. In addition, US fiscal policy is very loose in absolute terms and relative to other developed economies and this is unlikely to change whoever wins the election. Many US companies are also sitting on large cash piles, which has helped boost earnings as interest rates have risen.

Softer growth, easing labour market pressures and disinflationary trends will allow central banks to begin cutting interest rates in the next few months. The Fed and other central bank policies are clearly shifting from a focus purely on fighting inflation to a more balanced approach that stresses both price stability and strong employment. For example, Chair Powell has sent a powerful message by indicating that rate cuts are coming despite the Fed lifting its inflation and growth targets for 2024 and next year. Inflation still holds the key for Fed policy and the recent rise in energy prices and an escalation in geo-political tensions are threats. However, there is a good chance that the Fed’s preferred PCE measure could reach 2% before year-end as China continues to export deflation, wage growth moderates and rental inflation eases. In the meantime, inflation in the UK could be the real surprise as it hits 2% in the next month or so, maybe persuading the BoE to be the first to cut rates, having also been the early mover in pushing rates higher.

Evidence continues to mount that the return of geopolitics and the fracturing of the global economy are resulting in a changing World order. Consequently, we remain open minded on the “fire vs Ice” debate in terms of the longer-term outlook for inflation. Although we are leaning towards the former since shrinking work forces are here to stay and we expect easier fiscal policy across most developed economies, which will challenge central banks as it will be very difficult for them to keep rates as high as needed given global debt levels.

This macro backdrop should be positive for both bonds and equities over the next year or so as disinflation and softer growth enables central banks to start cutting rates. I think it matters less when the first rate cut materialises or how many we see this year, much more important is lower inflation being the catalyst for easier monetary policy and the avoidance of a prolonged or deep recession. As far as bonds are concerned, we continue to favour shorter maturity issues, partly because the yields remain superior and partly because the risks of higher inflation volatility long-term and bigger fiscal deficits will mean that investors demand a bigger risk premium for buying longer maturity issues. Corporate bonds should also deliver solid returns over the next year or two, but again we favour shorter duration and higher quality issues. The spread (excess yield) over safe assets available on credit is already very low in many cases and has limited room to compress further. Weaker growth than expected and rising default rates would almost certainly see spreads widen out, thus leading to lower returns.

Equities should continue to outperform bonds over the next couple of years since disinflationary growth is unambiguously bullish for the asset class. Admittedly, equity valuations are starting to look stretched in some areas, namely some of the magnificent seven and other mega cap growth stocks, and on a relative basis to bonds. After a strong run and given that quite a lot of “good news” is priced in, it would not be surprising to see a pause in the stock market recovery or even a period of correction. However, the combination of falling rates and bond yields, a recovery in earnings growth, a more benign liquidity environment and excitement around the potential for AI to boost long-term productivity growth and margins is a powerful tail wind for equities. There are early signs that the market is becoming more differentiating with a divergence in performance within the magnificent seven and a broadening out of the rally to include mid and small cap stocks, more value and cyclical -orientated sectors and emerging markets. We expect this trend to continue. Such a backdrop is also very supportive for our core themes. For example, as more companies and governments focus on finding ways to boost long-term productivity and growth through the adoption of new technologies, including in the healthcare space. In addition, an improving growth outlook for both developed and developing economies and rising real incomes should be positive for our global consumption theme.

There are no guarantees that the path forward for the global economy, central bank policy and financial markets will be smooth. The global macro and geo-political environment remains challenging and uncertain and as always, there are plenty of risks that could derail our positive outlook. The main threats include the Fed keeping policy too tight for too long, a spike in oil prices due to an escalation in either the Middle East or Ukraine, a Chinese devaluation or a turn for the worse in either the growth or inflation outlook. Provided nothing comes around to disrupt the key drivers for markets, namely a soft landing, the powerful mega trends led by AI, falling inflation and the prospect of imminent rate cuts, we remain optimistic for the rest of 2024 and beyond.